Table of Contents

Nuun Auto Trader

3S Coding is a custom software development company that specializes in building customized trading software solutions for its clients. The company has a team of experienced developers who can create complex trading algorithms and strategies using the latest technologies and programming languages. They also offer consulting services to help traders optimize their trading strategies and improve their overall performance.

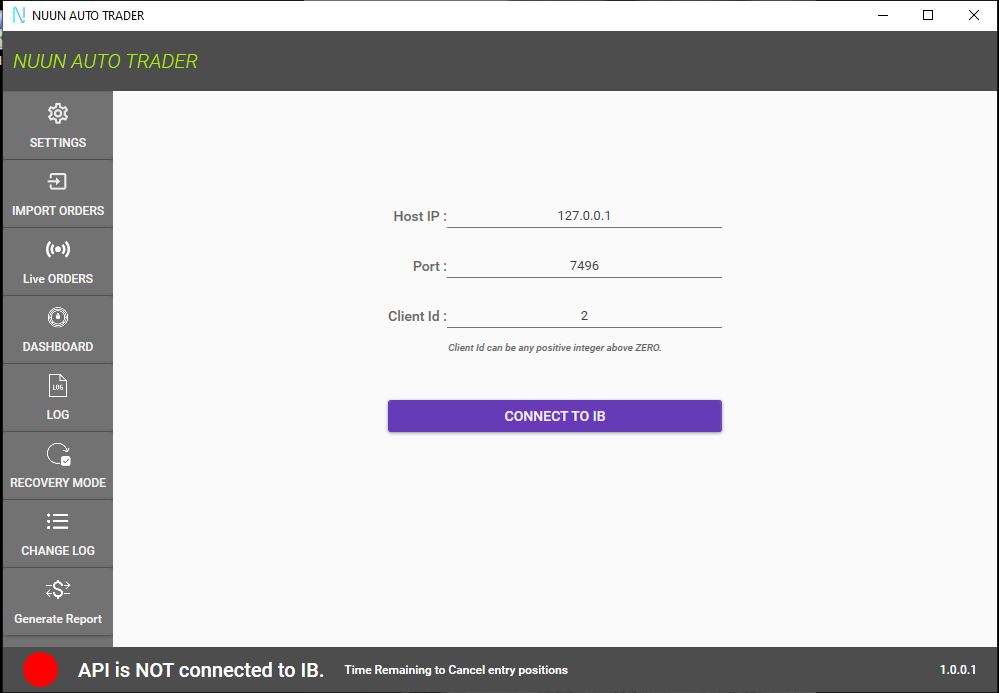

NUUN Auto Trader is a trading automation software developed by 3S Coding that allows traders to automate their trading strategies. With NUUN, traders can connect to Interactive Brokers through the IB API and execute trades automatically based on predefined rules and algorithms. NUUN also offers features such as real-time monitoring of exposure, risk management, and automated order execution. NUUN is designed to be user-friendly, and it can be easily customized to suit the needs of individual traders.

Custom trading strategy automation can offer several benefits to traders, including increased efficiency and accuracy, reduced emotional bias, and the ability to trade multiple strategies simultaneously. Automation eliminates the need for manual order entry, which can save time and reduce the risk of errors. It also allows traders to backtest and optimize their strategies to improve their performance over time. Custom trading strategy automation can be tailored to individual trading styles and preferences, making it a powerful tool for traders who want to take their trading to the next level.

Understanding NUUN Auto Trader

What is NUUN?

NUUN is a trading automation software developed by 3S Coding that is designed to automate trading strategies for traders. It is a user-friendly, customizable, and reliable platform that enables traders to connect to Interactive Brokers via the IB API to execute trades automatically based on predetermined rules and algorithms.

NUUN offers several features, including real-time monitoring of exposure, risk management, and automated order execution. Traders can use NUUN to set the rules and actions that should be taken, the orders are fed to NUUN via csv files. NUUN is a comprehensive trading automation tool that can help traders improve their performance and optimize their trading strategies.

How does NUUN work?

NUUN uses a sophisticated algorithmic trading engine that is capable of executing trades automatically based on predefined rules and algorithms. To use NUUN, traders must connect to Interactive Brokers via the IB API, which provides real-time access to market data and trading tools.

Once connected, traders can use NUUN to set the trading rules, such as when to cancel the maximum exposure as well as when the orders should be closed and what type of orders should be placed to close the orders. NUUN take all the input orders from CSV files that should be exported from the testing software and places the orders with IB.NUUN allows traders to specify the conditions for entering and exiting trades, such as technical indicators, price levels, and other criteria. When the conditions are met, NUUN will execute the trade automatically.

NUUN also offers real-time monitoring of exposure and risk management features that allow traders to manage their positions effectively. Additionally, NUUN can execute orders across multiple accounts simultaneously, making it a powerful tool for professional traders and institutions.

Features of NUUN

NUUN offers several features designed to help traders automate their trading strategies and manage their positions effectively. Some of the key features of NUUN include:

- Automated trading: NUUN can execute trades automatically based on predefined rules and algorithms, eliminating the need for manual order entry.

- Real-time monitoring: NUUN offers real-time monitoring of exposure and risk management features that allow traders to manage their positions effectively.

- Customization: NUUN is a customizable platform that allows traders to create custom trading strategies or use prebuilt strategies provided by the software.

- Multi-strategy trading: NUUN can execute orders across multiple strategies simultaneously, making it a powerful tool for professional traders and institutions.

- Recovery Mode: NUUN is equipped with recovery mode that helps the trader in case anything not planned happen such as server shutdown, TWS shutdown. It can go back to the state where it was before the shutdown updates for all the actions and activities that happened during the down time and continues.

- Special features:

- Delayed Entry

- MOC exit

- Limit order Exit at specified time

- Market Order Exit at specified time

- Delayed MOC orders

- Close extra filled orders due to gap opens

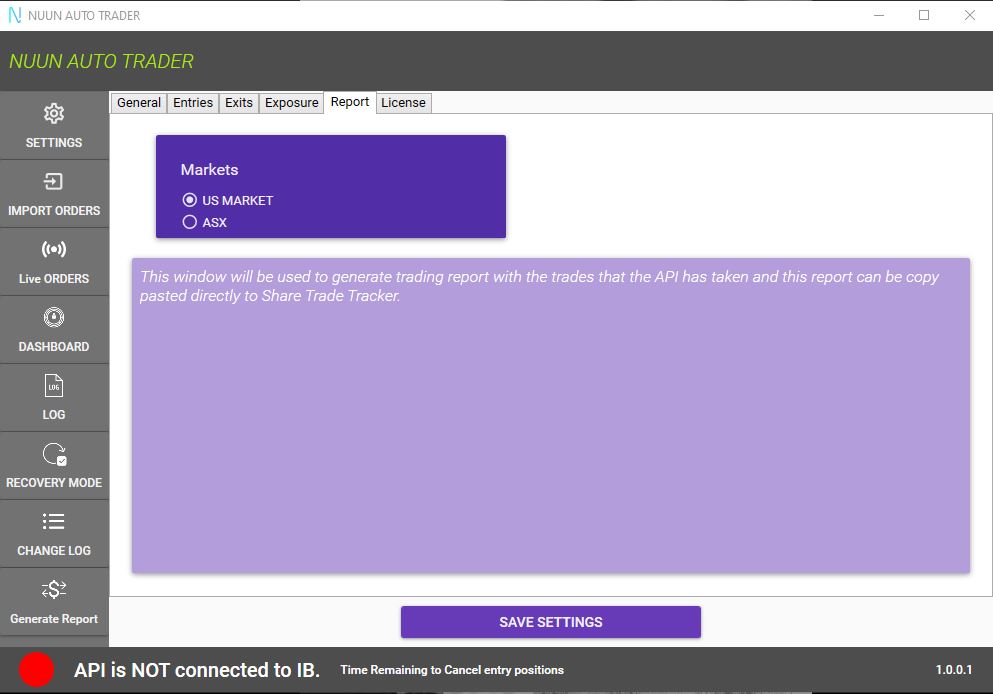

- Generate trade report with commissions

- Auction Orders for ASX

Advantages of using NUUN

NUUN offers several advantages to traders, including:

- Increased efficiency: NUUN automates the trading process, eliminating the need for manual order entry and reducing the risk of errors.

- Improved accuracy: NUUN can execute trades automatically based on predefined rules and algorithms, reducing emotional bias and increasing accuracy.

- Customizability: NUUN is a customizable platform that can be tailored to individual trading styles and preferences.

- Real-time monitoring: NUUN offers real-time monitoring of exposure and risk management features that allow traders to manage their positions effectively.

- Freedom: NUUN allows traders to place their orders and continue with their lives without the need to sit all the trading session in front of their monitors.

Interactive Brokers and IB API

Overview of Interactive Brokers

Interactive Brokers is a leading online brokerage firm that provides access to global financial markets. The company offers a wide range of financial products, including stocks, options, futures, currencies, and bonds. Interactive Brokers is known for its advanced trading tools, low commission rates, and sophisticated trading platforms.

Explanation of IB API

The Interactive Brokers API (IB API) is a software interface that allows traders to connect to the Interactive Brokers trading platform and access its trading tools and market data. The API provides a real-time streaming interface to market data, allowing traders to make informed trading decisions based on the latest market information.

The IB API is a powerful tool for traders who want to develop custom trading applications or integrate their trading strategies with other software systems. It supports a wide range of programming languages, including Java, C++, Python, and .NET, making it accessible to developers with different skill sets.

Benefits of using IB API

There are several benefits to using IB API for trading automation and custom trading applications:

- Real-time data access: IB API provides real-time access to market data, allowing developers to create trading algorithms and strategies that can be executed automatically.

- Customizability: IB API is a highly customizable tool that allows developers to create custom trading applications that can be tailored to individual trading styles and preferences.

- Integration with Interactive Brokers: IB API is specifically designed to integrate with the Interactive Brokers trading platform, providing access to a wide range of trading tools and resources.

- Cost-effective: IB API is a cost-effective solution for traders who want to automate their trading strategies or create custom trading applications. It allows traders to reduce the cost of trading by eliminating the need for manual order entry and reducing the risk of errors.

- Scalability: IB API is a scalable solution that can be used by individual traders as well as institutional clients. It can handle high volumes of data and can execute trades across multiple accounts simultaneously.

Custom Trading Strategy Automation

Custom trading strategy automation is the process of using computer programs to automate the execution of trading strategies that have been designed by individual traders. The process involves the use of custom software that can monitor the market and execute trades according to the rules specified by the trader.

At 3S Coding we develop custom trading automation based on the client requirements. Most of the time we implement the rules and the parameters in the automation to give the trader the flexibility to modify and change. Custom automation is useful for traders that have scalping in mind, since they can benefit from the execution speed and the Consistency since with automation there is no human interactions and feelings.

Custom trading strategy automation is useful for traders for several reasons:

- Efficiency: Automated trading can execute trades faster and more efficiently than manual trading, reducing the risk of missed opportunities and errors.

- Consistency: Automated trading can execute trades according to pre-defined rules, eliminating the impact of emotions and biases that can affect manual trading.

- Diversification: Automated trading can execute multiple strategies simultaneously, allowing traders to diversify their portfolio and reduce risk.

We have developed several automations that work on FOREX, FUTURES, STOCKs as well as Cryptos.

Recap

Trading automation is a must for traders because it offers several benefits, including:

- Efficiency: Automated trading can execute trades faster and more efficiently than manual trading, reducing the risk of missed opportunities and errors.

- Consistency: Automated trading can execute trades according to pre-defined rules, eliminating the impact of emotions and biases that can affect manual trading.

- Diversification: Automated trading can execute multiple strategies simultaneously, allowing traders to diversify their portfolio and reduce risk.

- Free time: Automation can do all the work instead of the trader which will give more free time to do other stuff.

For traders looking for trading automation solutions, 3S Coding offers a range of custom software products that can meet their needs. Their flagship product, NUUN, is a strategy trading automation that can be connected with Interactive Brokers via IB API to execute trades based on pre-defined rules. NUUN offers a range of features, including real-time monitoring of market conditions, exposure monitoring, and trade execution.

In addition to NUUN, 3S Coding offers custom trading strategy automation solutions tailored to individual traders’ needs. Their team of experienced developers can work with traders to develop custom software that can automate their trading strategies and improve their trading performance.

If you’re looking for a reliable custom software development company that delivers high-quality results, look no further than 3S Coding. Contact us today to discuss your project and how we can help you achieve your software development goals.